Tips to importers of Prepared Animal Fodder Merge your Commercial Invoice and Packing List for all your future exports MEIS, Merchandise Exports from India Scheme What is Bank post shipment credit to exporters? Service Tax - Click here to read complete notification under Budget 2014 What are the risks and solutions in Export Business?Ĭlick here to know India Trade Classification(ITC)

When does overseas buyer prepare Purchase order or Letter of Credit.

PROFORMA INVOICE VS PURCHASE ORDER HOW TO

Other details on how to import export Difference between MAWB and HAWBĭifference between MBL and HBL. The above information is a part of Guide on howtoexport and import Would you like to add more information about Commercial Invoice and Proforma Invoice? Share your experience below about Proforma Invoice and Commercial Invoice.ĭiscuss below about Proforma invoice and Commercial Invoice. In this article, I have explained about Commercial Invoice and Proforma Invoice in Exports and Imports.

PROFORMA INVOICE VS PURCHASE ORDER PRO

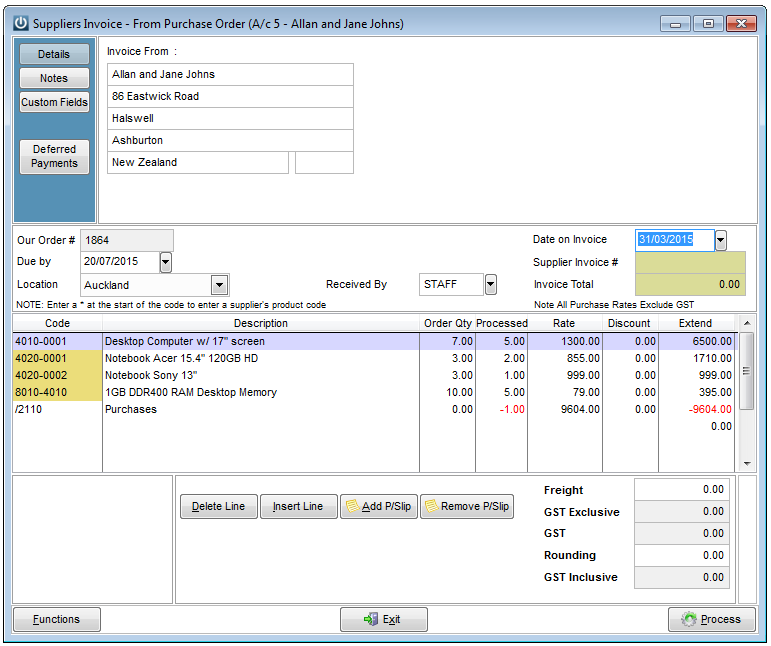

You can also read Difference between Purchase Order and Pro forma Invoice and Difference between Purchase Order and Commercial Invoiceĭo pro-forma invoice accepts in your country for import customs clearance? Comment below. to process import customs procedures to release cargo out of country. However, in some countries, pro-forma invoice is accepted in lieu of commercial invoice. However, the final sale price may vary with the pro-forma invoice, as pro-forma invoice is issued prior to actual sale takes place. The content of commercial invoice is almost same as pro-forma invoice. Commercial invoice is used to record ‘accounts receivable’ for the seller and accounts payable for the buyer. Invoice is a prime document of sale in any business. The seller issues commercial invoice at this point of time. As per agreed date of shipment, the seller arrange to ship the goods. Once after receiving pro-forma invoice from the supplier, the buyer sends a purchase order or opens a letter of credit to the supplier. The pro-forma invoice is issued before sales takes place. In other words, we can treat the pro-forma invoice as a ‘confirmed purchase order’ from the seller, although the official purchase order has to be issued by the buyer. So, we can treat pro-forma invoice as a document of commitment to sell the goods to the buyer as per the terms and conditions agreed between both in person, over telephone, by fax, email or any other mode of communication. Normally, purchase order or Letter of credit is opened on the basis of this pro-forma invoice sent by the seller. Just before this process, the seller has to send a ‘pro-forma invoice’ to buyer, mentioning complete details of agreement of sale. Once after agreeing the terms of contract of sale, the buyer has to issue a purchase order or Letter of Credit. Let us discuss – ‘when the pro-forma invoice is issued’ and ‘when invoice is issued’. ‘What is pro forma invoice’, ‘What is commercial invoice’ and ‘what is the difference between commercial invoice and pro forma invoice’. One of the common questions arises in a business terms is the ‘difference between pro forma invoice and invoice’. The information provided here is part of Online business guide courseĭifference between ‘Pro forma Invoice’ and ‘Commercial Invoice’ in Export Import Trade Posted on 08 April 2023 Category : Export

0 kommentar(er)

0 kommentar(er)